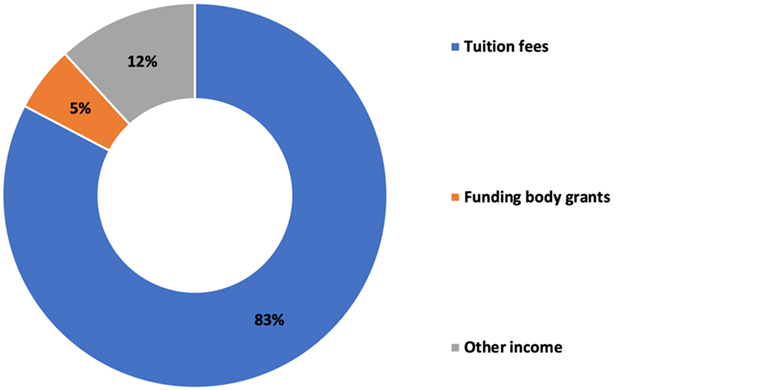

The money values have been taken from the published and audited University Financial Statements but are presented in a format to provide useful information to students and stakeholders.

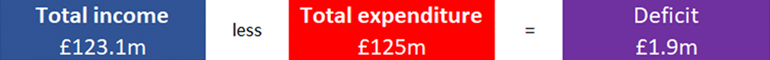

The University’s Results for the year 1 August 2022 to 31 July 2023

Income

Total University income was £123.1m for the year. The sources of income for every pound received is shown in the following graph.

Total income £123.1m split as follows:

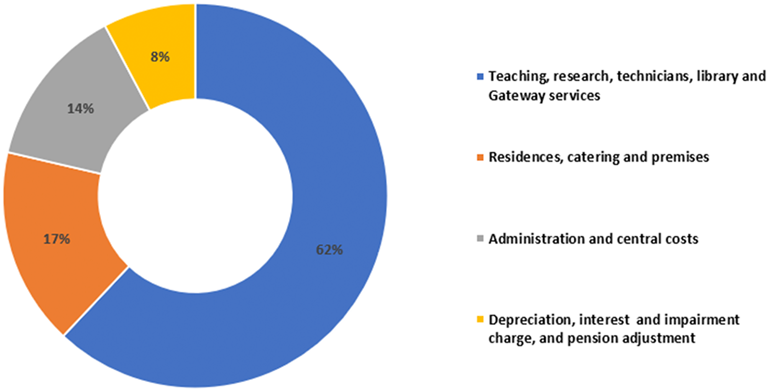

Expenditure

Total University expenditure was £125m for the year. The area of expenditure for every pound spent is shown in the following graph.

Total expenditure £125m

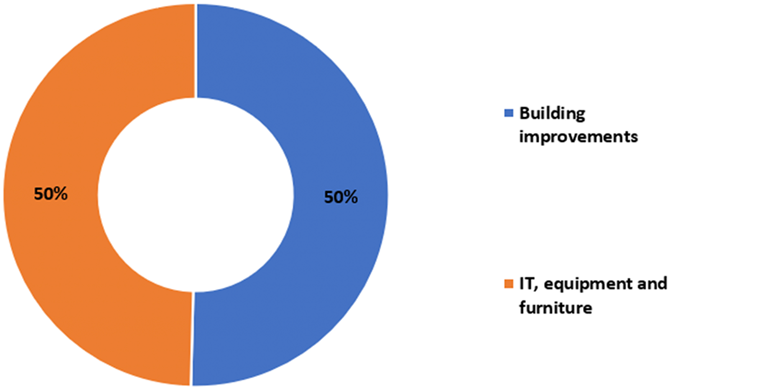

Investment

In addition to annual on-going charges, the University invests in its estate by making improvements to buildings and purchasing new equipment.

Investment of 11.6m

For more information on our finances, visit our What we Spend section.